We understand the needs of our investors for targeted investment solutions and their goals of attractive risk-adjusted returns. For this reason, we have decided to focus our investment strategy on diferent types of financial markets, but our strategy is not limited to them. Our skilled team is actively looking for investment opportunities.

Our Risk Management team oversees all aspects of both financial and non-financial risks including Market and Liquidity Risk, Counterparty Risk, Model Risk, Operational Risk, and Technology Risk. The firm employs a robust Enterprise Risk framework, which provides for a strong governance structure and ensures independence in risk making decisions. Chilin Capital is a diverse and fully integrated alternative asset manager. We have the breadth and depth to source ideas, evaluate opportunities and allocate capital across strategies and geographies. We employ a global multi-strategy investment approach, opportunistically engaging in a broad array of trading and investing strategies across a wide group of diversified managers.

We believe it’s important for Risk Management to interact closely with the Portfolio Management, Research, and Trading teams, working together in managing risk. Together, we aim to ensure that portfolios are manageable through sudden and severely adverse stress events. Chilin Capital’s systematic strategies are all underpinned by the belief that markets, rather than being efficient, exhibit hard-to-detect yet identifiable patterns.

Equities

Chilin Capital’s equities team employ their deep expertise to invest in the equity and equity-linked securities of companies across the globe. We seek to generate alpha by combining fundamental stock selection with proprietary analytical methodologies.

Chilin Capital’s equities team employ their deep expertise to invest in the equity and equity-linked securities of companies across the globe. We seek to generate alpha by combining fundamental stock selection with proprietary analytical methodologies.

Commodities

Chilin Capital’s commodities team seeks to generate alpha through directional and relative value strategies across both physical and financial commodities markets.

Chilin Capital’s commodities team seeks to generate alpha through directional and relative value strategies across both physical and financial commodities markets.

Trend Strategy

Chilin Capital’s systematic trend-following strategy is built on ongoing and extensive experience of momentum investing. We are able to identify opportunities from multiple angles and multiple disciplines.

Chilin Capital’s systematic trend-following strategy is built on ongoing and extensive experience of momentum investing. We are able to identify opportunities from multiple angles and multiple disciplines.

Multi-Style Strategy

These strategies harness the diversification and potential return benefits of investing in multiple well-known styles in an integrated fashion.

These strategies harness the diversification and potential return benefits of investing in multiple well-known styles in an integrated fashion.

Quantitative Strategies

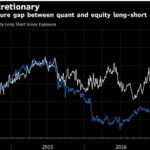

Chilin Capital’s quantitative strategies team seeks to generate alpha by combining rigorous fundamental research with mathematical and statistical models to identify and execute on investment opportunities.

Chilin Capital’s quantitative strategies team seeks to generate alpha by combining rigorous fundamental research with mathematical and statistical models to identify and execute on investment opportunities.